A massive story more than the earlier two yrs has been the rise in household rates. There are a lot of variables at perform. Limited provide is one. An influx of individuals shifting to additional appealing places is one more. But growing desire costs are threatening to stymie the housing sector. There are even fears that some of the latest gains could be reversed.

That has pushed property improvement suppliers House Depot (High definition -2.82%) and Lowe’s (Reduced -2.27%) very well down below the highs they attained at the end of previous year. But these fears might be supplying buyers an option. Is one particular of them superior than the other? Wall Avenue thinks so. And these charts display why.

Image source: Getty Images.

A single is generally far more highly-priced than the other

For the previous decade, Wall Avenue has been keen to spend a higher valuation for Residence Depot than for Lowe’s. As the valuation of the all round inventory industry oscillated, the two residence enhancement merchants did a dance of incredible predictability. Resembling poles of two magnets repelling each and every other, the price-to-gross sales ratios kept their length.

Hd PS Ratio info by YCharts

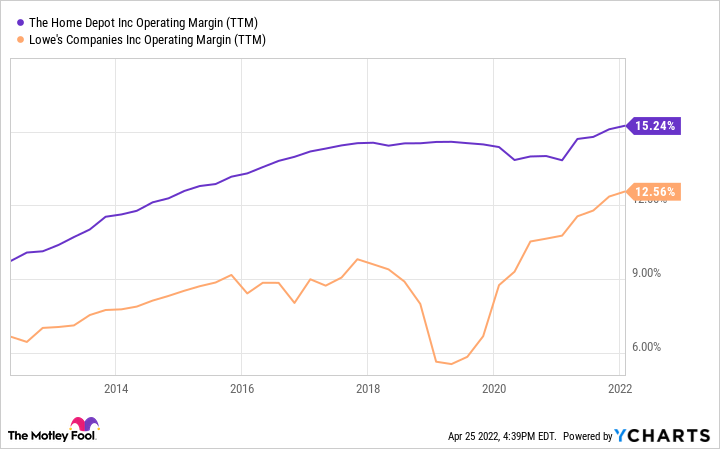

It truly is also persistently extra rewarding

A single excellent clarification is Property Depot’s profitability. Over that 10 years, its operating margin stayed at the very least a single-fifth better than that of Lowe’s. The company not too long ago warned that earnings margins would experience as costs surge.

Management went so significantly as to constitution its possess cargo ship to avoid the snarled worldwide source chain. Historically, Lowe’s has put in more on expenses like sales, marketing, and administrative functions these as human resources and accounting. In 2021, the change was about a little a lot more than 2% of revenue — approximately the gap in running margin.

Hd Running Margin (TTM) details by YCharts

In sharp distinction to history, the recent update at Lowe’s was optimistic. In February it lifted its whole-yr estimates for gross sales and earnings.

And it is in a better posture to take care of its personal debt

One particular region exactly where Lowe’s would seem extra interesting is the total of credit card debt it carries in comparison to Household Depot. It has $30 billion in mixed shorter- and prolonged-time period financial debt on its harmony sheet. Household Depot has $45 billion.

But digging a tiny deeper reveals that Household Depot is in a more powerful financial placement, due to the fact it generates almost 2 times the earnings prior to desire and taxes (EBIT). That usually means its occasions curiosity attained ratio — the variety of situations the EBIT can deal with once-a-year curiosity payments — is a great deal larger.

Minimal Periods Desire Earned (TTM) data by YCharts

It has developed speedier, way too

All of this neglects the a single metric a lot of traders prioritize over all many others: growth. Here also, Household Depot wins. Neither enterprise is in hypergrowth mode, and both of those benefited a large amount for the duration of the pandemic from consumers’ willingness to spend on housing. But above the past five- and 10-yr intervals, the top rated line at Loew’s has expanded at a slower speed.

High definition Income (TTM) info by YCharts

Which 1 pays you more to have shares?

Investors might hope Lowe’s to make up for these perceived shortfalls by spending a bigger dividend to shareholders. They would be incorrect. Property Depot’s distribution far exceeds that of Lowe’s. It has for most of the previous decade.

Hd Dividend Yield info by YCharts

That doesn’t account for all of the methods to return capital to shareholders. Lowe’s has done substantially far more stock buybacks in the previous couple a long time. In fact, it has repurchased 17% of shares exceptional in just the previous 3 many years. Household Depot has bought again just 6%.

Lowe’s also has much more room to enhance the dividend in the long run. It sends considerably less than just one-quarter of income again to shareholders as dividends. For Property Depot, the range is about four-fifths. Even now, each can quickly do it for the foreseeable foreseeable future.

Is the shifting of the guard close to?

If you might be seeking to incorporate a person of the huge-box house enhancement stores to your portfolio, the historic metrics make a persuasive case for Residence Depot about Lowe’s. But that could be changing. Differing 2022 outlooks and an intense buyback software have Lowe’s searching and sounding like the previous Home Depot that Wall Avenue fell in like with.

Both of those offer buyers exposure to an industry at the heart of the American overall economy. With sturdy funds return packages, reliable margins, and manageable credit card debt, there is no completely wrong selection. But Property Depot has proved it can execute around time. Which is why I would lean toward it if pressured to select. Of study course, there’s no rule towards acquiring both equally.

More Stories

Home Improvement Goals for Modern Living

Creative Home Improvement on a Budget

Fast Home Improvement Wins for Busy People