Landlords have experienced to offer with faux tenant purposes for yrs. But rental fraud artists upped their video game and have gotten more and more sly in their tries to evade history checks for rental houses.

How can you guard you and your financial investment from these con artists? We preferred to share what to observe out for and how to seem for discrepancies in applications.

Underneath, you’ll understand what landlords need to know about the soaring quantity of rental cons.

How can you guard your investment from rental cons?

Rental scams can depart a real estate investor out of hundreds of bucks in missing lease or residence damages. The greatest line of defense? Landlords want to vet their tenants appropriately. Seriously, obtain out as much as you can about the sort of human being you are entrusting to are living in your expenditure.

For case in point, my property administration corporation has place various checks in area to display candidates. We’ve produced a screening matrix to score candidates on factors like credit history, profits, previous rental history, and previous because of balances.

With a long time of expertise, our crew developed this matrix as a scoring technique to assess hazard. Candidates acquire a “score” among .00 to 6.25 or higher (the decrease, the greater):

- .00 – 3.50 Very low Risk (Stability Deposit = 1-month rent or 1-thirty day period surety bond)

- 3.75 – 5.00 Ordinary Danger (Stability Deposit = 1-thirty day period rent or 2-month surety bond)

- 5.25 – 6.00 Bigger Risk (Stability Deposit = 3-thirty day period hire or 3-month surety bond)

- 6.25 + Denied or co-signer necessary

This matrix provides us a fast goal way to assessment candidates, but as you’ll see beneath, it’s by no suggests foolproof. So you will need to have to get your private investigator hat and magnifying glass out.

Who commits fraud and why?

The motives for committing fraud range as a great deal as the people today committing the crime. Some just cannot afford the lease, some have no intention of paying out lease, and some others want to cover prior economic transgressions.

Right now, nearly absolutely everyone can change copies of “official documents” with their telephones. From time to time, you have to dig deeper to uncover the rip-off.

Don’t get me improper we never usually think everyone’s out to pull 1 around on our clientele. But if someone has almost nothing to conceal, they shouldn’t get defensive when you begin asking inquiries.

By the way, if another person does get defensive, choose that as a pink flag and contemplate denying their application.

But if the figures really do not increase up, addresses never look at out, or social media profiles recommend anyone incredibly different, ask why.

Detecting fraudulent shell out stubs

Once more, most candidates are genuine possible tenants who want to rent your residence and pay back hire correctly. Nonetheless, those handful of poor apples necessarily mean you have to retain your guard up.

When an applicant submits their evidence of revenue, specially fork out stubs, pay out close interest to the deductions and watermarks. Seem to see if check quantities match pay out stubs, much too.

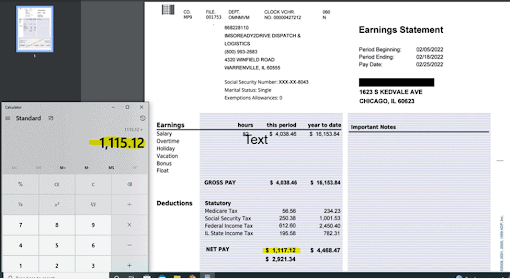

Here’s a new illustration of a fraudulent spend stub my firm acquired (names have been altered for privateness):

You’ll see that the deductions on the paystub didn’t insert up correctly. Also, if you seem carefully on the appropriate side of the check out, it says “ADP”. On the other hand, there is no ADP symbol at the top rated of the paystub. Most ADP checks display the emblem.

Does that make your Spidey Perception tingle? It should really! Time to get out that magnifying glass, far better identified as Google, to discover more about the applicant’s employer.

If a quick research does not convert up the supposed employer or if an aged man or woman solutions the “business” phone confused about why you are contacting, get suspicious. Sometimes when you inquire for further documentation like a W-2, the scammer is aware you are on to them, and they vanish. Look at you lucky for getting dodged a bullet.

Determining fraudulent documentation

Even when an individual submits documentation with tax IDs or supervisor facts, I advocate you validate every thing. We’ll see applicants claiming to have worked for a put for five many years. We found out that the “company” only filed for an LLC 4 months back on further more research. Hmmm, a thing does not incorporate up.

Items can get bizarre when a fraudulent software gets submitted on behalf of a entirely distinct human being. Use court data to confirm a good deal of info which is submitted. These information can present tons of information (from site visitors tickets to divorce proceedings to tackle discrepancies).

Credit score checks can unearth curiosities like home loans in other cities or signatures on deeds that never match application signatures. Once again, live by the motto: have confidence in but verify.

Closing thoughts

None of these discoveries tends to make my group tremendous-sleuths (despite the fact that they are very great). I wanted to exhibit the time and energy we place into earning absolutely sure we approve the right individuals and steer clear of rental frauds.

A superior evaluate procedure makes everyone’s position a lot simpler. Matrix scores only display component of the tale. They help weed out the easy denials, but you have to use your instinct to unearth these scammers.