Real estate investments come with several huge drawbacks.

Diversification poses a problem when a median home in the US costs nearly $400,000. Even when you leverage other people’s money and make a minimum down payment on an investment property, you still tie up tens of thousands in a single investment.

Then there’s the labor and expertise required to both find good deals on properties and manage them once bought. Compared to truly passive investments, real estate starts looking like a lot of work.

Enter: real estate crowdfunding investments.

Here’s a “cheat sheet” table comparing the six main real estate crowdfunding platforms available to all investors (not just wealthy accredited investors):

| Fundrise | Streitwise | Groundfloor | Arrived Homes | Yieldstreet | RealtyMogul | |

|---|---|---|---|---|---|---|

| Min. Investment | $10 | $5,000 | $10 | $100 | $500 | $5,000 |

| Investment Format | Pooled Funds & REITs | REIT | Loans | Fractional Ownership in Rentals | Pooled Fund | REITs |

| Real Estate Type | Residential & Commercial | Commercial (Office Space) | Residential (Hard Money Loans) | Single-Family Rentals | Real Estate, Art, Debt, Vehicles, Legal | Residential & Commercial |

| Dividend Freq. | Quarterly | Quarterly | N/A | Quarterly | Quarterly | Monthly & Quarterly |

| Dividend Yield Last Year | 2.9%-5.0% | 8.4% | N/A | Just Launched | 8.0% | 4.5% Growth REIT / 6.0% Income REIT |

| Total Return Last Year | 18.0%-25.1% | 8.4% | 9.9% | Just Launched | 5.0% | 15.2% Growth REIT / 14.9% Income REIT |

| Hold Time w/o Penalty | 5 Years | 5 Years | 3-18 months | 5 Years | 3+ Months | 3 Years |

| Built-In IRA | Yes | No | Yes | No | Yes | Yes |

| Year Launched | 2012 | 2017 | 2013 | 2021 | 2014 | 2013 |

| Brian Invests Personally | Yes | Yes | Yes | Yes | Not Yet | Not Yet |

| Learn More | Fundrise | Streitwise | Groundfloor | Arrived Homes | Yieldstreet | RealtyMogul |

What Are Real Estate Crowdfunding Investments?

Crowdfunded real estate platforms come in two broad categories. Before choosing platforms to invest with, make sure you understand the variations between and within real estate crowdfunding investments.

Crowdfunded REITs

A real estate investment trust or REIT is a fund that owns a pool of real estate-related investments.

Those crowdfunding projects might include properties directly owned by the fund, known as an equity REIT. In contrast, a debt or mortgage REIT owns debts secured by real property.

Equity REITs tend to offer more long-term growth potential. After all, they own properties, and real estate usually appreciates in value over time.

Debt REITs tend to offer better cash flow, paid out to investors in the form of dividends. Both long-term growth and ongoing cash flow and dividends play a huge role in reaching financial independence and retiring early.

Some REITs combine both direct ownership and loan investment strategies for a bit of both.

You can buy and sell shares in publicly-traded REITs through your regular brokerage account. But private crowdfunded REITs work differently: you buy shares directly from the company. That makes share prices far less volatile, since they don’t trade in real time on stock exchanges. But it also makes them less liquid, and difficult to sell. If you want to sell within the first few years of buying shares, many real estate crowdfunding platforms buy them back at a discount from what you paid.

One other important difference — the SEC regulates public and private REITs differently. Publicly-traded REITs must pay out at least 90% of their profits each year in the form of dividends. While that sounds peachy on paper, it prevents them from growing their portfolio by reinvesting profits in new properties. That severely limits their growth potential.

Crowdfunded REITs fall under no such restrictions. That gives them more flexibility to reinvest profits and grow their funds’ portfolios, and therefore grow share values.

Secured Loans

Not all crowdfunded real estate platforms pool investments into REIT funds. Some instead operate as investment property lenders, offering loans to real estate investors.

They raise the money for these loans from the public: you. You can review the available loans to fund, and pick and choose which ones you like. You decide how much you want to invest toward any given loan; sometimes as little as $10.

These loans tend to be short-term, fix-and-flip loans. Loans to buy fixer-uppers, renovate them, and then either sell as flips or refinance as rentals (the BRRRR strategy).

That makes them short-term investments — a rarity in the world of real estate investing.

Secured loans offer strong passive income, but no long-term appreciation potential. You own debt, not equity investments in any real estate assets.

Accredited vs. Retail Investors

Because of the way real estate crowdfunding is regulated by the SEC, many crowdfunding platforms don’t allow retail investors — mom-and-pop investors like you and me.

Instead, they can only accept money from accredited investors. These are wealthy investors who must meet one of two criteria to qualify:

- A net worth over $1 million (not including equity in their primary residence) or

- Annual income over $200,000 for each of the last two years, and the expectation that you will earn at least that much again this year ($300,000 for married couples filing jointly).

At the risk of getting preachy, the SEC basically says, “We don’t think anyone but the rich is sophisticated enough to invest in high-risk, high-return investments, so we’re not going to let them invest how they see fit.” Good thing we have paternal Uncle Sam telling us what we can and can’t do with our own money.

So, in any discussion of the best real estate crowdfunding investments, you have to divide them into two camps: those available to accredited investors only and those available to all the rest of us.

Best Real Estate Crowdfunding Investments for Non-Accredited Investors

Since most of us don’t qualify as accredited investors, let’s start with the best crowdfunded real estate platforms for retail investors.

Note that nearly all of these offer long-term investments only. Most real estate crowdfunding sites expect you to leave your money invested for at least five years.

Rather than fixating on management fees for these crowdfunded real estate platforms, I focused on rate of return. The sad fact is that real estate investment platforms can hide fees easily, so their disclosed fees mean little. For example, if they do maintenance in-house, they can bill as much as they want as an hourly rate, to pad their profit margin.

1. Fundrise

I invest in Fundrise myself, and have been largely happy with it so far.

They operate using the pooled fund model, like a REIT. Technically, they operate many REITs, and spread your money among them depending on your investment settings.

Fundrise invests in a combination of residential projects (mostly apartment buildings) and secured loans. They do own commercial properties in their investment portfolio as well, along with some single-family rental properties. Your money spreads among many of their real estate projects, which helps you diversify.

The more you invest, the more control you have over how your money is allocated. At the $10 and $1,000 levels, you have no control at all. With a minimum of $5,000, you have a little control, opting between their Supplemental Income, Balanced Investing, and Long-Term Growth allocations. If you invest $10,000 or more, you get access to their Plus plans, which allow you to “allocate a portion of your portfolio to more sophisticated real estate strategies that evolve over time based on new market opportunities.”

They also offer a Premium option with a minimum investment of $100,000, available only to accredited investors. This allows access to more private offerings, including fractional ownership in individual rental properties.

Fundrise allows you to set up automated monthly investments and automated dividend reinvestment. They’re also partnered with a custodian to allow investing through a self-directed IRA.

Fundrise paid an average return of 22.99% in 2021. Their Long-Term Growth fund earned 25.12%. In the first quarter of 2022, Fundrise earned an average return of 3.49% (13.96% annualized). Compare that to the S&P 500, which lost 4.60%.

Read our full Fundrise review here for more information.

Bottom Line: A great starting point for diversified real estate investing.

Minimum Investment: $10

Type: Pooled funds holding residential & commercial real estate and secured debts.

2. Streitwise

I also have money in Streitwise, which invests primarily in commercial real estate.

Specifically, Streitwise invests largely in office space in second and third tier cities, such as Indianapolis, San Antonio, Minneapolis, and Chandler, AZ. The founders have over $5 million of their own money tied up in the investments, for skin in the game.

From 2017-2021, they’ve paid out average dividends of 9.4%. However, recent dividend yields have hovered around 8.3-8.4%, where I expect them to stay.

Still, those are some pretty spectacular dividend yields. They offer a great investment for compound interest.

Unfortunately, Streitwise recently raised their minimum investment from $1,000 to $5,000. That put it out of reach for some, and will spook away other crowdfunding-curious investors.

Like Fundrise and most other real estate crowdfunding investments, Streitwise expects you to leave your money in the pot for at least five years. If you sell early, they may buy back your shares at a discount.

I appreciate Streitwise’s transparency around their returns. It bothered me when Fundrise removed both their past returns and future return forecasts from their website, even though returns didn’t decline.

Consider Streitwise an excellent option to gain broad exposure to US commercial real estate.

Bottom Line: A high-yield, easy starting point for passive commercial investing in many real estate markets.

Minimum Investment: $5,000

Type: Pooled REIT fund holding commercial real estate.

3. GroundFloor

GroundFloor takes a completely different approach to real estate crowdfunding investments.

Unlike pooled REITs such as Fundrise and Streitwise, GroundFloor is a hard money lender. They issue short-term fix-and-flip loans to real estate investors, and you can pick and choose which loans you want to invest in. Most loans are for 12 months, plus or minus a few months.

Best of all, you can invest as little as $10 toward any given loan.

When the borrower sells the property or refinances, you get paid back with interest. You can turn around and reinvest the money in new loans or pocket your money and walk away.

Of course, all loans come with risk of default. But because GroundFloor lends investment property loans, they aren’t subject to the regulation on homeowner mortgages. GroundFloor also lends a much lower loan-to-value ratio (LTV) than homeowner loans, usually in the 50-80% range. So if the borrower defaults, GroundFloor simply forecloses and sells the property to recover their — your — money.

I invest in GroundFloor myself and have been mostly happy with it so far. A few loans have had borrowers default, and I continue to watch how GroundFloor handles the process. But the overwhelming majority of their loans repay on time.

The trick? To invest a little money in a lot of loans.

As for returns, GroundFloor grades each loan on risk, and charges borrowers accordingly. They pay between 6.5-14% interest on loans, depending on risk grade.

GroundFloor also raises money by borrowing money directly in the form of private notes. They currently pay 7% interest for 12-month notes.

Bottom Line: A high-yield, easy way to invest in real estate-secured debt without a long-term commitment.

Minimum Investment: $10

Type: Individual short-term loans, private notes.

4. Arrived Homes

Rather than pooled REIT funds or loans, Arrived buys single-family rentals, and sells fractional shares in them.

You can buy fractional ownership in a rental property for as little as $100. That’s the lowest minimum investment I’ve ever seen for buying into an individual property, even lower than our co-investing program (more on that later).

Investors earn both rental cash flow and property appreciation. Arrived pays out rental cash flow quarterly to all investors, proportionate to their ownership percentage. And when they sell the property, typically after five to seven years, the profits get split proportionally among all investors. For each property, they show a city-level average of both historic appreciation and annual cash flow, to provide a sense for expected returns on each.

See the 90-second demo video below for how buying shares on Arrived works.

They do charge a one-time, up-front fee for finding the deal, plus a 1% asset management fee each year.

Bottom Line: A simple and affordable way to buy partial ownership in individual rental properties.

Minimum Investment: $100

Type: Fractional ownership in single-family rental properties.

5. Concreit

Newcomer Concreit shakes up the real estate crowdfunding model by letting you withdraw your money at any time.

That kind of liquidity is nearly unheard of among other real estate crowdfunding platforms. There’s no early withdrawal penalty on your principal, although if you pull money out within the first year, they ding your dividend payout by 20%.

Concreit pays a fixed 5.5% annual dividend yield. But they pay dividends every single week, making it another strong investment for compound interest. So, even if you withdraw your money in the first year and take the 20% dividend penalty, that still leaves you with a dividend yield of 4.4%.

Like many other platforms, Concreit owns a portfolio of loans secured by real property. At last check, they owned 155 loans across the US.

Because these are short-term loans similar to Groundfloor, they turn over quickly and leave Concreit with plenty of liquidity. You can pull your money out whenever you feel like it, although Concreit can’t guarantee instant liquidity because they’re not an FDIC-insured bank.

Best of all, you can start investing with as little as $1.

Bottom Line: A reliable, highly liquid way to invest in real estate short-term, with a 5.5% dividend yield.

Minimum Investment: $1

Type: Pooled fund owning short-term real estate-secured loans.

6. DiversyFund

As a growth-driven REIT, DiversyFund takes a different approach, reinvesting all of their profits in new properties to build their real estate portfolio faster.

They estimate they can return 10-20% per year on investors’ money through their aggressive growth strategy. Impressive returns by any standard, if they deliver on their forecasts.

The drawback is that investors receive no dividends in the meantime. Investors must rely on long-term appreciation and growth to deliver their returns in 5-7 years.

Which raises a related issue: you can’t easily sell your shares early. DiversyFund is a long-term investment, hard stop.

However DiversyFund does allow a low minimum investment ($500), making it accessible to many individual investors. Their strategy centers around multifamily apartment buildings spread among many cities nationwide.

Bottom Line: A long-term investment focused on growth rather than dividends.

Minimum Investment: $500

Type: Pooled REIT that buys and manages multifamily properties.

7. Lex Markets

Lex Markets offers its own fresh spin on liquidity: it has a built-in secondary market to buy and sell shares.

It owns several commercial properties, and lets investors buy fractional shares in each property separately. You can bid a certain amount for shares, or offer shares for sale at a share price you name, just like public stocks and ETFs. And just like stock exchanges, you can see what other buyers and sellers have offered.

So, there’s no long-term commitment to hold shares in Lex Markets properties. You can sell at any time for the going market price, or set limit orders.

As of mid-2022, Lex Markets only offers shares in two properties: a mixed-use garage in Portland, OR, and a mixed-use building in New York City. It has two more commercial properties advertised as coming soon, in Seattle and Nashua, NH.

If you like the idea of investing in commercial real estate with full liquidity, check out Lex Markets.

Bottom Line: A more liquid real estate crowdfunding investment, allowing you to buy and sell shares of commercial properties instantly.

Minimum Investment: 1 Share (varies by market pricing)

Type: Fractional ownership in commercial real estate buildings.

8. RealtyMogul

RealtyMogul splits the difference, offering two different REITs. Their MOGULREIT I pays higher dividends with less emphasis on long-term growth. It currently pays a 6% annual dividend, paid monthly.

In contrast, their MOGULREIT II pays a lower dividend yield of 4.5%, with a greater emphasis on long-term appreciation. Both REITs hold multifamily real estate and commercial properties.

RealtyMogul also offers individual investment property partnerships, where you can buy fractional ownership in single properties. Investors can even take advantage of 1031 exchanges with these investments. However they only allow accredited investors to participate in these.

RealtyMogul has a relatively long history in the real estate crowdfunding investment space, and has provided stable returns over that time. They enjoy a strong reputation among investors.

Unfortunately, the minimum investment remains high at $5,000.

Bottom Line: A reliable crowdfunded real estate platform, with both income-oriented and growth-oriented options.

Minimum Investment: $5,000

Type: Pooled REITs that buy and manage commercial and multifamily properties.

9. Yieldstreet

Yieldstreet offers a mix of many alternative investments. In addition to real estate, they provide access to art, consumer loans, commercial loans, vehicle loans, legal finance, cryptocurrencies, nonfungible tokens (NFTs), and more.

However only Yieldstreet’s Prism Fund allows non-accredited investors. It functions as a mixed-asset fund that owns a blend of the assets outlined above. With a minimum investment of $500, it remains an accessible way to diversify across many alternative asset classes.

I like that Yieldstreet doesn’t charge an early share sale penalty. But they do limit share buybacks to 5% of their total outstanding shares per quarter, on a first-come, first-served basis.

Some of their other investment offerings available to accredited investors include:

-

- Pantera Early Stage Token Fund I: Digital assets such as NFTs and cryptocurrencies. Minimum Investment: $25,000

- Art Equity Fund II: High-end art. Minimum Investment: $10,000

- Dallas-Fort Worth Multifamily Equity I: A three-story apartment complex in the Dallas-Fort Worth metro area. Minimum Investment: $15,000

- North Shore Boston Multifamily Equity: A mid-rise apartment building on Revere Beach in Boston’s North Shore suburb. Minimum Investment: $5,000

- Harbor Group Multifamily Equity Portfolio II: A portfolio of 19 multifamily apartment buildings across several cities. Minimum Investment: $40,000

Yieldstreet also offers a series of structured note portfolios, funds which own loans to blue chip companies.

When you’re ready to diversify beyond real estate into even more alternative investments, start with the Yieldstreet Prism Fund.

10. Modiv

In 2019, NNN REIT bought crowdfunded real estate platform Rich Uncles, and in 2021 rebranded as Modiv. They then switched from a private real estate crowdfunding platform to a publicly-traded REIT.

I mention them here to clarify their history, but as a public REIT, they no longer count as a real estate crowdfunding investment.

(article continues below)

Want to compare investment property loans?

What short-term fix-and-flip loan options are available nowadays?

What short-term fix-and-flip loan options are available nowadays?

How about long-term rental property loans?

We compare several buy-and-rehab lenders and several long-term landlord loans on LTV, interest rates, closing costs, income requirements and more.

Best Real Estate Crowdfunding Investments for Accredited Investors

Have more than a few nickels to rub together?

Wealthier investors have more options for real estate crowdfunding investments. Here are a few of the better ones.

1. Bricken Investment Group

I know Sam Wilson — the rather sharp mind behind Bricken Investment Group — personally, even if we aren’t exactly hanging out every weekend. We’ve chatted a few times over video, and he hosted me on his How to Scale Commercial Real Estate podcast, which we rank among the best real estate investing podcasts.

I haven’t done a deal with them yet myself, as a non-accredited investor, although I hope to sneak in the door of their next deal as a sophisticated investor. Bricken Investment Group buys commercial and multifamily real estate and allows you to partner with them on individual properties.

Much of real estate partnerships come down to trust, and I find Sam to be both trustworthy and knowledgeable in the industry.

Bottom Line: Experienced large-scale real estate investors cherry-pick strong deals for investing partnerships.

Minimum Investment: $25,000-50,000

Type: Individual commercial and multifamily properties for syndication.

2. Real Wealth

I’ve also worked with the folks over at Real Wealth, and have found them to be straight shooters — and true experts in real estate investing.

They offer real estate syndications for accredited investors through crowdfunding large real estate deals. They work across many types of real estate, from residential to commercial to land and beyond.

I particularly respect their commitment to education, which is something we take seriously here at SparkRental. They publish an excellent real estate investing blog and podcast.

Bottom Line: Experienced investors find strong deals for group investments.

Minimum Investment: Varies by deal.

Type: Individual commercial, residential, and land properties for syndication.

3. CrowdStreet

CrowdStreet is considered by many to be the best real estate crowdfunding platform in the market.

They’ve consistently scored high returns for investors, ranging from 11.5-26.4%. Of the 473+ commercial real estate properties they’ve bought, they’ve sold 44 of them, with a strong track record on returns.

Accredited investors can invest in either a pooled portfolio of properties or individual deals, allowing plenty of flexibility. However investment minimums start at $25,000 — hardly chump change.

CrowdStreet also requires a long-term investment, with no easy options for selling shares early. Plan to leave your money invested in these real estate offerings for at least five years.

Bottom Line: Strong returns for accredited investors willing to leave their money tied up for years.

Minimum Investment: $25,000

Type: Both pooled funds and individual commercial and multifamily properties for syndication.

4. EquityMultiple

EquityMultiple allows you to invest in either property-secured debt or equity in individual properties. They claim strong returns since launching in 2015, averaging 16.8%.

The minimum initial investment is technically $5,000, although most projects require a minimum of $10,000-20,000. Still, that proves more reasonable than most real estate crowdfunding investments catering to accredited investors.

The platform focuses on commercial real estate. They’ve recently started offering several tax-friendly ways to invest in real estate, including Opportunity Zones and 1031 exchanges.

As with most real estate crowdfunding investments, expect to leave your money tied up for years. These are long-term, illiquid investments, but you get direct access to large scale real estate investment deals.

Bottom Line: Strong long-term returns with multiple investing options and several tax-friendly structures available.

Minimum Investment: $5,000

Type: Secured debt or equity in individual properties.

5. PeerStreet

Similar to GroundFloor, PeerStreet lets you pick and choose individual loans to fund.

You can also set up automated investments as new loans become available after setting your investing criteria.

On the plus side, the loans come with short terms, so you don’t need to tie up your money indefinitely. It also comes with a relatively low minimum investment of $1,000.

But I see little advantage here over GroundFloor — which lets retail investors participate, and provides more transparent interest rate and default rate information on its website.

Bottom Line: An easy way to invest in real estate-secured debt without a long-term commitment.

Minimum Investment: $1,000

Type: Individual short-term loans, private notes.

6. Roofstock One

Know the turnkey rental property marketplace Roofstock?

In 2019, they launched a crowdfunded investment program called Roofstock One. The platform allows you to invest in two distinct ways. First, you can buy Common Stock: shares in a pooled REIT that owns dozens of single-family rental homes across many states. The REIT’s assets constantly shift as they buy and sell properties.

Alternatively, you can buy Tracking Stocks: shares in portfolios of specific properties. For example, one portfolio might own eight rental properties in the Atlanta metropolitan area. You effectively become a fractional owner in each of those eight properties.

Both types of shares distribute dividends quarterly, and appreciate in value over time. Investors can generally expect dividends in the 3-4% range, plus annual appreciation in the 3-5% range.

My concern about Roofstock One is the lack of clarity around redeeming (selling) shares. There’s no secondary market to sell shares — although Roofstock One says they may build one — and there’s no guarantee that you can sell shares back to Roofstock either. Their offering circular outlines a Redemption Plan for Common Stock, but caps it at 1.25% of outstanding shares each quarter, with no legal obligation to redeem shares. As far as I can see, there’s no policy at all for buying back Tracking Stocks, although the platform will likely sell the properties after five or six years and pay out investors then.

Bottom Line: An easy way to diversify among single-family rentals, but double check your available exit strategies.

Minimum Investment: $5,000

Type: Fractional shares in portfolios of single-family rental properties.

7. AcreTrader

To diversify even further, you can add farmland to your portfolio with AcreTrader.

AcreTrader buys farmland to lease to farmers. Each parcel goes into a unique LLC, and as an investor you buy shares in that LLC, making you a direct owner of the property. Each share equals one-tenth of an acre.

You collect annual dividends in the 3-5% range, and when AcreTrader sells the property after five or ten years, you of course get a proportional payout on the appreciation. AcreTrader aims for an internal rate of return (IRR) of at least 7-9%, but claims that the historical IRR on farmland is 12%.

The minimum investment varies based on the price per acre of the parcels AcreTrader buys. AcreTrader typically requires you to buy at least one to four acres. Expect a minimum investment in the $10,000 – $25,000 range.

Technically, you can sell your shares privately to other investors. But don’t expect easy liquidity — AcreTrader doesn’t offer a built-in secondary market for buying and selling shares.

Bottom Line: Another way to diversify further, adding agricultural land to your portfolio.

Minimum Investment: $10,000 – $25,000

Type: Fractional shares in farmland parcels.

Final Thoughts

I love real estate crowdfunding investments almost as much as I love buying rental properties myself. They offer a great way to diversify your portfolio, and therefore reduce risk, without sacrificing on returns.

In fact, I invest in real estate as an alternative to bonds. When you can earn similar annual returns on passive crowdfunding projects as you can from mutual funds or the stock market, while diversifying to a completely separate asset class, you reduce risk without sacrificing return on investment.

But no investment comes risk-free, and you need to fully understand the risks inherent in each real estate investment opportunity before committing your money. Do your due diligence, invest wisely, and come back and let me know about your experiences with crowdfunded real estate platforms!♦

What are your favorite real estate crowdfunding investments? Why?

More Real Estate Investing Reads:

Real Estate vs. Stocks: Which Is Faster for FI & Early Retirement?

House Hacking: 10 Ways to Live for Free (Even in a Single-Family Home)

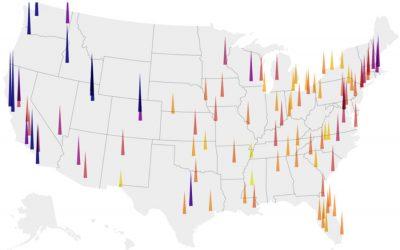

Best Cities for Real Estate Investing by GRM (Price/Rent Ratio)

About the Author

G. Brian Davis is a landlord, real estate investor, and co-founder of SparkRental. His mission: to help 5,000 people reach financial independence by replacing their 9-5 jobs with rental income. If you want to be one of them, join Brian, Deni, and guest Scott Hoefler for a free masterclass on how Scott ditched his day job in under five years.

I want to know more about…

Advertising & Tenant Screening

Leasing Issues

Renter & Property Management

Passive Income & Personal Finance

The post Real Estate Crowdfunding Investments: The Easiest Way to Diversify? appeared first on SparkRental.