Wellington Genuine Estate and the Happenings Considering the fact that Covid

When Covid strike the environment in March 2020 no one realized how it would affect the Wellington Florida genuine estate market. Would people today end providing their residences? Would individuals end shopping for residences? Would the market place occur to a halt, keep the exact or get busier?

Well, nobody knew and I don’t consider any person was well prepared for what was to come. The current market went from a sellers sector to an excessive sellers current market to a market place no person has at any time seasoned in advance of.

So let’s just take a look at the Wellington authentic estate marketplace and what’s been taking place about the final 2 yrs.

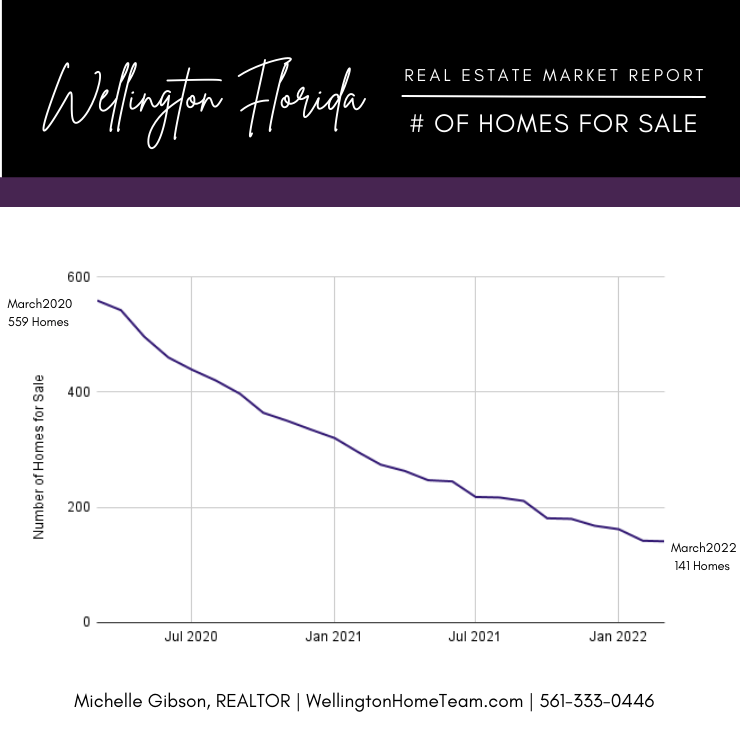

Quantity of Households for Sale in Wellington

March 2020 to March 2022

Because covid strike in March 2020, the variety of households for sale has been speedily reducing. In March 2020 Wellington had 559 houses for sale and by March 2022 we only experienced 141. You browse that appropriately, home inventory lessened by virtually 75% in 24 months. Back again then asking costs ranged from $149,000 to $40M and now they range from $295,000 to $36M.

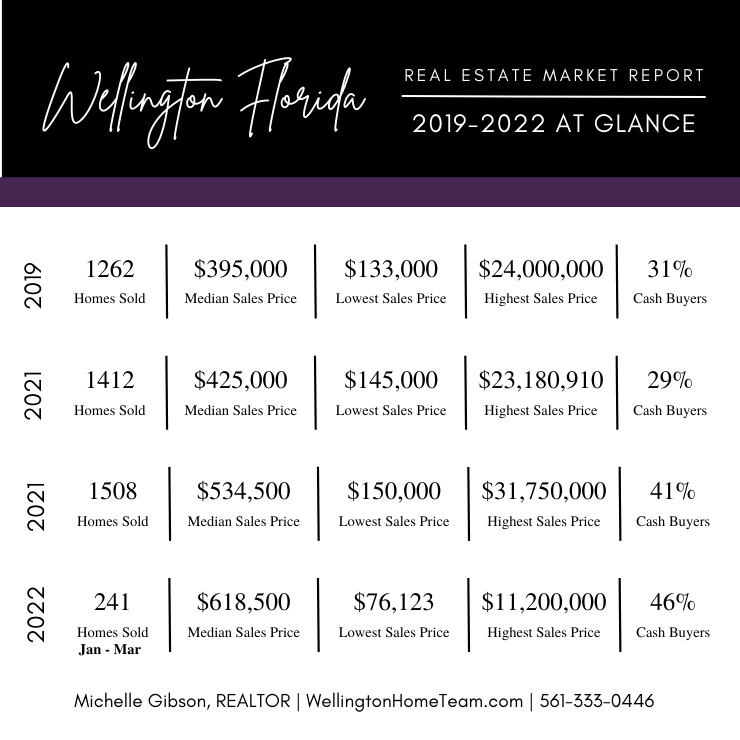

Wellington Home Income

2019 vs 2020 vs 2021 vs Now

Numerous persons presume the lack of household stock we’re suffering from in Wellington is for the reason that nobody is promoting their house but as you will see under that is not the circumstance. In order to paint a crystal clear image of what’s been occurring in the Wellington actual estate current market let’s go back to 2019.

In 2019 a overall of 1262 attributes sold in Wellington. The number of household profits enhanced by 12% in 2020 and it elevated an additional 7% in 2021. To date, 2021 experienced the maximum range of dwelling profits at any time, which totaled 1,508 gross sales. It also experienced the maximum median income cost of $534,500. However, 2022 is already on keep track of to established a new file for the median revenue rate and only time will inform if more than 1,508 homes will promote.

Is the Wellington Florida Authentic Estate Marketplace Likely to Crash?

Several persons believe the Wellington true estate market place is heading to crash. In reality, a lot of people today are counting on it and setting up their foreseeable future around it. Even though I do not have a crystal ball, I do have 20+ years of practical experience remaining a Wellington Real estate agent beneath my belt and I really don’t see the current market crashing.

So quite a few people today preserve evaluating our latest market to the market we experienced in 2004-2006. Back when assets value doubled in a handful of shorter several years and then tanked. Numerous home owners seasoned a 60% fall in home worth. So a great deal of property owners uncovered themselves upside down when it came to their home’s worth.

Perfectly, I can tell you firsthand that market is not this marketplace! Though the markets do have similarities they are extremely various and here’s how:

2004-2006 Marketplace VS 2020-2022 Current market

THEN: Sellers gained a several offers.

NOW: So many sellers are now acquiring 10, 20, and 30+ offers.

THEN: Sellers would uncover a buyer in a handful of days, occasionally a 7 days.

NOW: Sellers are locating buyers within several hours.

THEN: Virtually each solitary consumer was getting financing a initial and next home loan, 5/1 arm, adjustable-amount home loans, no revenue down mortgages.

NOW: 30-50% of purchasers are paying out hard cash at all selling price points or putting at the very least 20% down if they’re obtaining funding.

THEN: Home finance loan fascination costs were lower.

THEN: Home finance loan fascination costs were lower.

NOW: In excess of the last two years we have knowledgeable historically minimal premiums.

THEN: Customers had a number of contingencies with extended contingency durations.

NOW: Contingency intervals are limited and in some situations, consumers are taking away contingencies altogether.

THEN: Buyers could effortlessly get a mortgage loan well above their signifies with small to no documentation.

NOW: It is a lot a lot more hard for potential buyers to receive funding, they want far more than a pulse.

THEN: A greater part of residences appraised but if for some cause they did not quite often sellers worked with the consumer.

NOW: If a household doesn’t appraise not also lots of sellers are negotiable and the truth is they don’t have to be. Numerous customers concur in progress to arrive up with further cash to go over the appraisal shortfall, this is termed an appraisal hole.

THEN: Escalation clauses did not exist.

NOW: Consumers are distributing gives with an escalation clause stating they will spend $X previously mentioned the optimum supply the seller gets.

THEN: In roughly 2 years home worth doubled.

NOW: In 2 decades house has not doubled. However, residence price has now exceeded the peak of the market place back in 2005-2006.

THEN: The median income cost at the peak of the industry in 2005 was $420,000.

NOW: The median revenue rate in 2022 is $618,500.

THEN: The serious estate sector crashed. A property truly worth $500,000 in 2005 was well worth $185,000 by 2010.

NOW: There are no indicators of the current market crashing and assets worth carries on to climb.

So even though these two markets had similarities on the surface area they are definitely almost nothing alike.

If unqualified customers were acquiring financial loans and putting very little to no income down I’d concur historical past may repeat itself. However, that is not the circumstance, a whole lot of income is becoming pumped into our market. Quite a few potential buyers are having to pay hard cash, heaps and plenty of funds, and financed buyers are placing revenue down, which wasn’t the norm again in 2004-2006.

So when the current market shifts, which it inevitably will, do you imagine these purchasers are heading to very easily aspect with their income? I’d have to say they almost certainly will not. Immediately after the sector crashed customers had no situation “taking a loss” and offering their house as a small sale or letting it go into foreclosure because in a lot of conditions they weren’t dropping cash, the financial institution was.

Ultimately, only time will explain to what is really going to come about in the upcoming with the Wellington genuine estate market place but I don’t see a crash coming our way.

You should think about spreading the phrase and sharing Wellington Real Estate and the Happenings Considering that Covid

About the Creator

Top rated Wellington Real estate agent, Michelle Gibson, wrote: “Wellington Genuine Estate and the Happenings Since Covid”

Michelle has been specializing in residential true estate due to the fact 2001 during Wellington Florida and the encompassing area. Regardless of whether you’re seeking to obtain, offer or rent she will guide you by the overall serious estate transaction. If you are completely ready to set Michelle’s understanding and skills to work for you simply call or e-mail her these days.

Parts of provider include Wellington, Lake Really worth, Royal Palm Seashore, Boynton Seaside, West Palm Seashore, Loxahatchee, Greenacres, and far more.