In response to the COVID-19 recession, federal, point out and territory governments immediately furnished help to the housing market for two motives.

To start with, to safeguard positions and, 2nd, because investment decision in the housing and construction industries has a high financial multiplier influence.

Nonetheless, new analysis released nowadays exhibits even further housing stimulus measures will be necessary to assist travel an financial recovery into 2021 and outside of.

Our investigate found the several stimulus packages to day are far too compact to have a large influence on an economic recovery. It also discovered non-residential building, adopted by household building and then infrastructure expending, has the greatest multiplier result – the boosts in activity and incomes that movement on via the overall economy.

The housing industry welcomed the A$680 million HomeBuilder grant and associated condition and territory measures introduced in June to promote customer desire.

But, subsequent this kind of measures, our analysis suggests even further investment focused on housing offer, in unique social housing, will be needed to maintain a restoration.

The stimulus so far

The pandemic prompted quite a few business studies warning of enormous task losses and recommending the greatest methods to guidance the housing sector. Most prompt multi-billion-dollar buyer stimulus steps. A quantity recommended enormous investment decision in social housing.

Our research shows common sector assistance for the demand-side stimulus by governments. Dollars grants have already increased new land and residence profits appreciably in most states and territories, which will feed by into constructing function.

The exception is New South Wales in which the HomeBuilder plan was not expected to have a lot of an effects in Sydney thanks to the A$750,000 rate cap on eligibility.

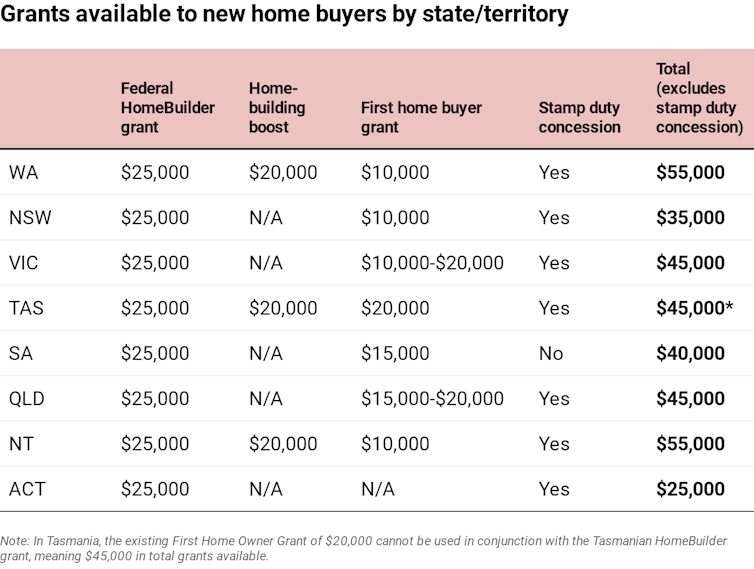

The table underneath exhibits the grants readily available to new dwelling consumers in every single point out and territory. Stamp duty concessions are also readily available in all but 1.

Supplied the dimension of this helping hand, it is hardly stunning several homes are wanting to consider gain of the techniques. The level of good results in Western Australia has resulted in the state government saying an extension to its developing reward scheme to meet up with need and support maintain new setting up activity into 2022.

The building gap

Even just before the pandemic, making activity had declined noticeably. COVID-19 produced issues even worse.

New dwelling commencements in 2019-20 are down appreciably on just two years in the past, ranging from a slide of 18% in South Australia to 29% in NSW and Queensland. The exception is Tasmania in which commencements have risen by 15%. The total fall in the 6 states in excess of this interval is 53,000 commencements.

The federal authorities expects HomeBuilder to stimulate the making of 27,000 housing units, with the prolonged very first residence loan deposit plan to incorporate another 10,000 units. A lot of this demand will be pulled ahead from 2021-22, as tends to be the scenario with grants.

As a consequence, from mid-2021 nevertheless much more stimulus will be wanted to maintain marketplace exercise. This assumes population progress remains lower.

Eventually, if govt is going to use the housing field to aid an economic restoration, the stimulus will have to be substantially even bigger. This might just get the industry back to pre-COVID amounts.

Just one way to plug some of the hole would be large investment decision in social housing. So much, though, only the states have committed to funding refurbishment and design of social housing.

Compare the A$680 million HomeBuilder funding to the Australian government’s GFC response. The A$5.6 billion Social Housing Initiative delivered practically 20,000 social housing units. A different A$5.8 billion went into the To start with Residence Owner Enhance and Electrical power-Successful Residences packages.

The Local community Housing Industry Association (CHIA) has referred to as for a A$7.7 billion federal stimulus bundle to grow Australia’s social housing provide by 30,000 homes. It has also thorough the economic advantages of this sort of investment. Of class, there are extensive-phrase social positive aspects as effectively.

More stimulus steps

Pretty much all interventions distort marketplaces and most build unintended behavioural outcomes, these types of as persons bringing ahead present strategies. But we should remember that the housing business, as a important employer, is an efficient way to promote the economy.

Internationally, governments have been spending huge on housing-connected infrastructure, social housing and steps to enhance the environmental sustainability of new and present housing. Australia’s stimulus steps are tiny by comparison.

Housing exercise is very likely to slump when the existing stimulus steps end. Superior unemployment and small population development are not excellent substances for a building recovery. Business will contact for even more assistance. When states have their possess stimulus measures, they need guidance from federal federal government to encourage the degree of new create action the economic climate desires.

Any further more demand-facet incentives need to be tailored to the qualities of unique marketplaces and specific where by most wanted – multi-residential progress, for example. A one particular-sizing-matches-all method will not operate or be an successful use of taxpayer funds. It is doable not all marketplaces will need even more intervention.

On the other hand, significant-scale funding of social housing infrastructure is necessary from a range of economic and social views. For illustration, outcomes are a lot more predictable due to the fact the range of extra units the investment decision provides is far more or less assured. And this creating exercise is not reliant on personal sector desire.

Rapid tax reform to stimulate institutional expenditure in economical housing and establish-to-rent developments could enable stimulate activity and produce housing for people in have to have.

Governments need to have to shell out notice to transforming patterns of consumer demand from customers and devote in spots with demand from customers pressures. This is probable to be an challenge in regional Australia where by markets are generally sluggish to react to need improvements. A lot of homes in the capital metropolitan areas are exhibiting desire in moving to regional places as COVID-19 carries on to condition tastes for distinct destinations and housing types.

The COVID-19 housing story is much from above.

This post is by Steven Rowley, Professor University of Economics, Finance and Home, and Director, Australian Housing and Urban Investigation Institute, Curtin Investigate Centre, Curtin College Adam Crowe, PhD Prospect, Faculty of Structure and the Designed Environment, Curtin University Catherine Gilbert, Postdoctoral Research Affiliate, College of Sydney Chris Leishman, Professor of Housing Economics, College of Adelaide Jian Zuo, Professor, School of Architecture and Created Setting, University of Adelaide, and is republished from The Conversation under a Innovative Commons license. Browse the unique short article.